Large Cap Equity Fund: How to Build Wealth with Smart Investments

Investing in a Large Cap Equity Fund is one of the smartest ways to grow your money safely.

Investing in a Large Cap Equity Fund is one of the smartest ways to grow your money safely. These funds focus on big, stable companies with strong track records, making them less risky than smaller stocks. This guide will show you how to make smart choices, maximize returns, and avoid common mistakes. For beginners, you can also explore our guide on Best Mutual Fund Strategies for New Investors to understand other fund options.

Understanding Large Cap Equity Funds

A Large Cap Equity Fund invests primarily in companies with a large market value. These companies are leaders in their industries, have steady earnings, and are less likely to collapse during market downturns.

Why Large Cap Equity Funds Are Popular

Stability: Big companies are reliable and survive market ups and downs.

Consistent Growth: Their stock prices tend to rise steadily over time.

Dividends: Many pay regular dividends, which can increase your income.

By investing in these funds, you benefit from both safety and growth potential.

How Large Cap Equity Funds Help You Grow Money

There are two main ways Large Cap Equity Funds build wealth: capital growth and dividends.

Capital Growth

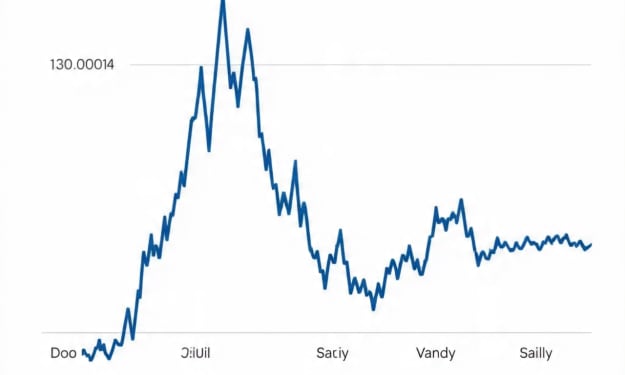

When the stock prices of companies in the fund rise, your investment grows. Smart investors watch the market and choose funds with the potential for steady appreciation.

Dividend Income

Dividends are payments companies give to their shareholders. Reinvesting dividends can accelerate your wealth over time without extra effort.

Insider Tips from Experienced Investors

Big investors use strategies that can help you get more from Large Cap Equity Funds.

Timing Your Investment

Experienced investors study market trends and economic indicators to decide the best time to invest. Timing your entry and exit points can boost your returns.

Diversify Within Large Caps

Even within large companies, they invest across different sectors. This spreads risk while taking advantage of growth in multiple areas.

Choose High-Quality Funds

Not all funds perform equally. Big investors analyze past performance, fund management, and fees before investing. Choosing the right fund can significantly impact long-term growth.

Steps to Choose the Right Large Cap Equity Fund

Choosing the right fund is crucial for success. Here’s what you should focus on:

Check Past Performance

Look at consistent performance over several years. While past performance doesn’t guarantee future returns, it indicates stability.

Review Fund Manager Experience

A skilled fund manager can handle market fluctuations better. Their expertise plays a key role in protecting and growing your money.

Compare Fees

High fees can eat into profits. Look for funds with reasonable costs but strong returns.

Understand Fund Strategy

Some funds focus on growth, others on income through dividends. Pick a fund that aligns with your financial goals.

Risks You Should Know

Even though Large Cap Equity Funds are safer, they are not risk-free.

Market Risk

Stock prices can fall if the market declines. Diversifying and investing long-term can help reduce this risk.

Inflation Risk

If your fund grows slower than inflation, your money loses real value. Choose funds with steady growth potential.

Sector Risk

Investing only in one industry can be risky. Diversify across sectors to reduce potential losses.

Tips for Beginners

- Start small and gradually increase investment.

- Reinvest dividends to grow wealth faster.

- Keep a long-term perspective; avoid reacting to short-term market swings.

- Review your fund occasionally but don’t over-monitor daily changes.

Conclusion: Secure Your Future with Large Cap Equity Funds

A Large Cap Equity Fund offers a safe and reliable way to grow your money. By learning strategies used by experienced investors, choosing the right fund, and managing risks, you can achieve steady financial growth. Start investing today, stay patient, and let your wealth grow steadily over time. For more investment guidance, check our article on Mutual Fund Tips for Long-Term Success to explore other smart strategies.

Comments

There are no comments for this story

Be the first to respond and start the conversation.