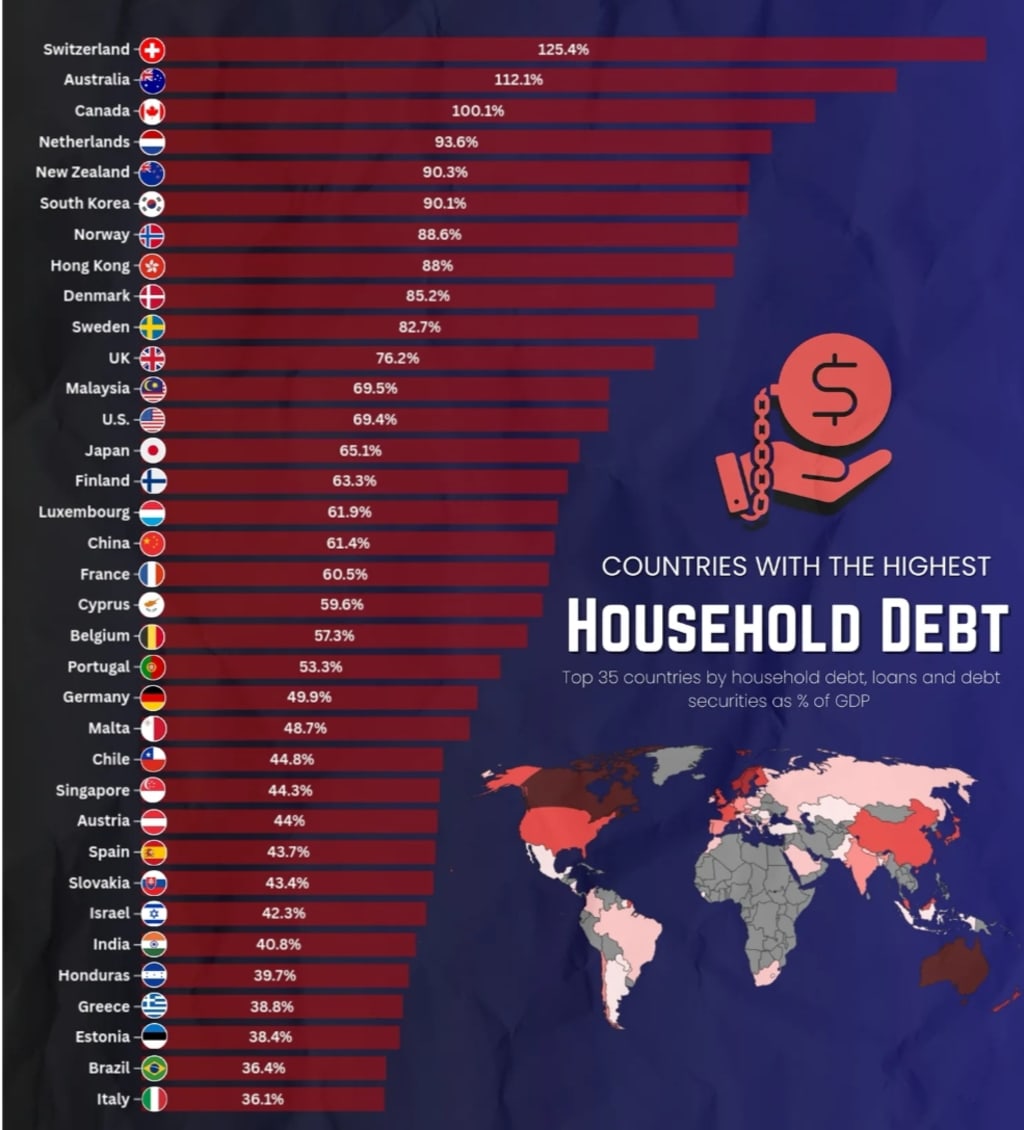

Charted: The 35 Countries with the Highest Household Debt

Understanding the global landscape of household borrowing

Household debt has become a major economic indicator, reflecting not only the financial habits of citizens but also broader economic trends in each country. From mortgages and personal loans to credit cards and other forms of borrowing, household debt levels provide insight into consumer confidence, government policies, and potential financial vulnerabilities.

Recent data has revealed the 35 countries with the highest household debt, highlighting stark differences between economies and the factors driving borrowing trends worldwide.

What Household Debt Tells Us

Household debt is often expressed as a percentage of a country’s Gross Domestic Product (GDP). A high ratio does not automatically indicate financial trouble, but it can signal increased economic risk if borrowing is excessive relative to income.

High household debt can result from:

Rising property prices leading to larger mortgages

Easy access to credit and consumer loans

Economic policies encouraging borrowing

Cultural attitudes toward debt and saving

Conversely, low household debt may reflect either conservative financial behavior or limited access to credit.

Top Countries by Household Debt

According to the latest global statistics, the countries topping the household debt charts are predominantly high-income, developed economies. These nations often have well-developed credit markets, high home ownership costs, and strong consumer spending.

Notable Countries with High Household Debt:

Denmark – Consistently ranks highest, with household debt exceeding 100% of GDP.

Australia – High property prices and widespread mortgage borrowing drive debt levels.

Netherlands – Mortgage-heavy household debt, often linked to favorable tax deductions.

Norway – Strong economy but high reliance on home loans.

Sweden – Rising property markets contribute to debt accumulation.

Other countries on the list include the United States, Canada, South Korea, Switzerland, and New Zealand, each showing household debt above 80% of GDP in recent surveys.

Factors Driving Household Debt

While the top-ranking countries vary geographically, similar factors contribute to high household debt:

1. Housing Costs

In many developed nations, property prices have increased faster than incomes, forcing households to take on larger mortgages. High urbanization and limited land availability exacerbate this trend.

2. Access to Credit

Countries with mature financial systems offer easy access to credit cards, personal loans, and mortgages, often at low interest rates. This accessibility encourages higher borrowing.

3. Economic Confidence

Strong economies can foster consumer confidence, making households more willing to borrow for homes, education, or consumption.

4. Policy and Tax Incentives

Some countries, like the Netherlands and Sweden, provide tax deductions for mortgage interest, further encouraging borrowing.

Risks Associated with High Household Debt

While debt can stimulate economic growth by supporting spending and investment, excessive household debt carries financial risks:

Vulnerability to interest rate hikes: Households may struggle with repayments if rates rise.

Economic shocks: Job losses or economic downturns can lead to defaults.

Reduced consumer spending: High debt obligations can limit discretionary spending.

Housing market corrections: Over-leveraging on mortgages can amplify property market volatility.

Economists warn that countries with household debt exceeding GDP may face financial instability during economic crises.

Comparing Debt Levels: Developed vs. Emerging Economies

Interestingly, many emerging economies show lower household debt ratios, often below 30–40% of GDP. Reasons include:

Limited access to credit or underdeveloped financial systems

Cultural preference for savings over borrowing

Lower property prices relative to income

However, low household debt does not automatically mean economic resilience, as these economies may be vulnerable to other forms of financial risk.

How Household Debt Impacts Policy

Governments and central banks monitor household debt closely because it influences monetary policy and financial stability. High debt levels may lead to:

Stricter lending regulations

Higher capital requirements for banks

Adjustments to interest rates to prevent over-borrowing

Public campaigns promoting financial literacy

Policymakers aim to strike a balance between encouraging economic activity through credit while preventing unsustainable debt accumulation.

Household Debt Trends in 2026

Current trends suggest household debt is rising in several countries due to:

Inflation pressures increasing living costs

Continued demand for housing in urban centers

Expansion of consumer credit products

Some countries are showing caution, with governments introducing measures to curb excessive borrowing and prevent housing bubbles.

Lessons from the Global Debt Landscape

Examining the 35 countries with the highest household debt provides insights into:

How wealthier nations manage credit and consumption

The relationship between housing markets and financial stability

The potential risks of over-leveraged households in economic crises

It also serves as a reminder for households to borrow responsibly and for governments to maintain balanced financial regulations.

Conclusion

Household debt is a critical indicator of both economic health and financial vulnerability. The charted 35 countries highlight how income levels, housing markets, financial systems, and policy decisions contribute to borrowing patterns.

While high household debt can support growth and investment, it also brings risks that require careful monitoring by policymakers, banks, and households themselves. Understanding these trends is essential for anyone looking to navigate personal finances or grasp the broader implications of global economic patterns.

Comments

There are no comments for this story

Be the first to respond and start the conversation.