Dave App Promises “Up to $500 in 5 Minutes

as It Recasts Everyday Banking for Speed and Simplicity

Dave App Promises “Up to $500 in 5 Minutes” as It Recasts Everyday Banking for Speed and Simplicity

TAMPA, Fla. — In a financial landscape where time and predictability often matter as much as dollars and cents, the Dave app is positioning itself as a fast, flexible companion for day‑to‑day money management. The pitch is bold: get up to $500 in as little as five minutes through ExtraCash®, then settle it later with no interest and no late fees. The pathway is straightforward—download the app, connect an existing bank account, open an ExtraCash account, and move the funds into a Dave Checking account for immediate use.

Behind the headline number is a broader promise: to make cash flow less stressful for people who need a short bridge between expenses and payday. Instead of revolving balances or compounding interest, Dave leans on transparent settlement. You borrow what you need (within your eligible limit), you see your repay‑by date up front, and you square up without finance charges that can turn a short‑term fix into a long‑term burden. The value proposition is speed plus clarity—an antidote to overdrafts and opaque fees.

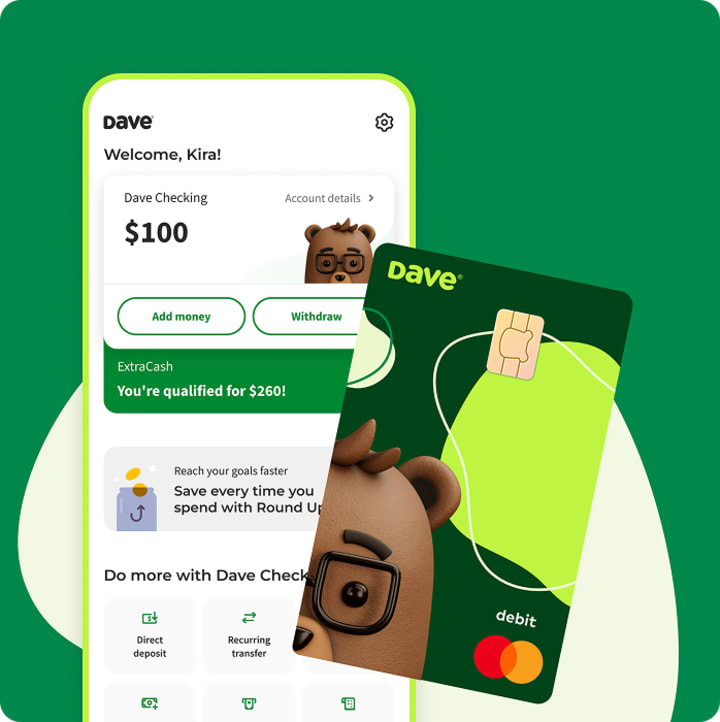

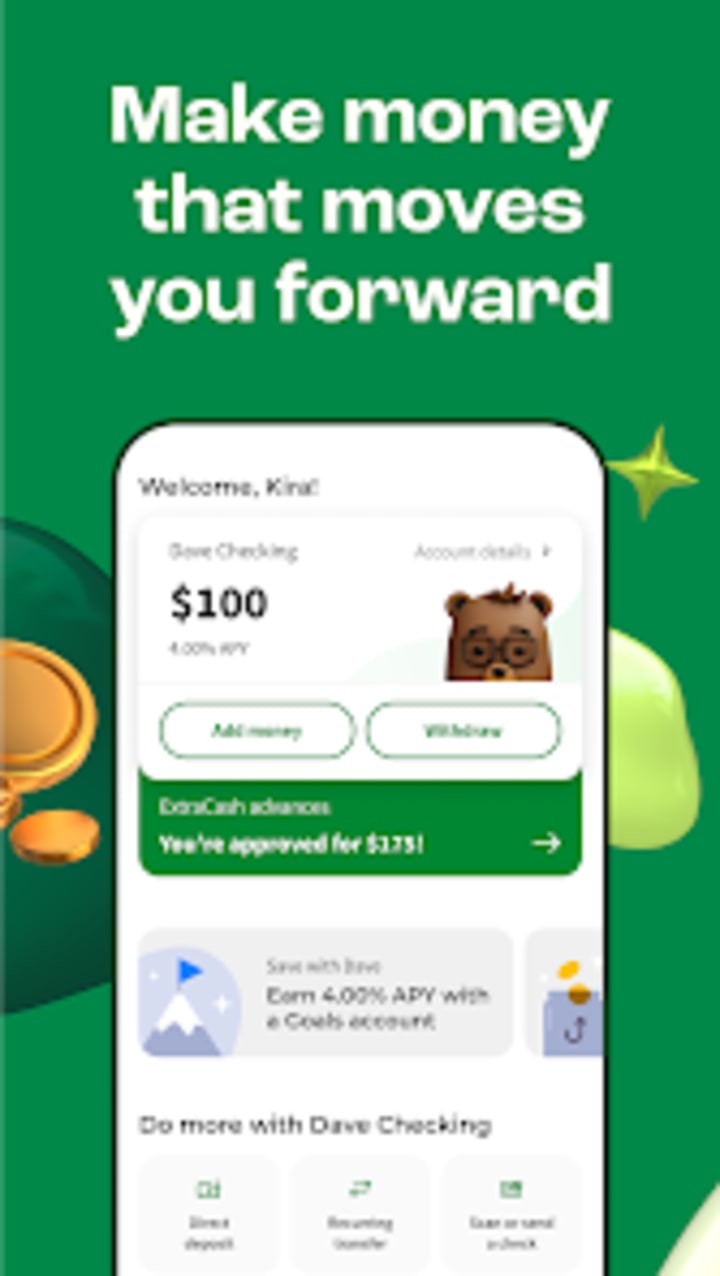

A Checking Account Built for Everyday Control

The Dave Checking account serves as the app’s operating center. It’s where users can receive ExtraCash and spend it immediately with a linked debit card. The account folds in useful quality‑of‑life features: early direct deposit—often up to two days ahead of the scheduled payday—and the ability to Round Up purchases, automatically pushing the spare change into savings.² For many, these touches can be the difference between “getting by” and finally building a small, steady cushion.

Importantly, Dave positions itself against the nickel‑and‑diming that has long defined traditional checking. The marketing is blunt: no minimum balance fees and no ATM fees on Dave’s side of the ledger.³ While ATM operators may still charge their own surcharges, the promise is that Dave won’t add extra friction just because your balance dips or you need cash on the go. It’s a message tailored to workers juggling variable income, shift schedules, or gig assignments—people who can’t afford hidden costs simply for accessing their own money.

Savings That Start Small—And Stay Visible

Safety, Support, and the Fine Print That Matters

Trust is table‑stakes in finance, and Dave highlights FDIC insurance up to $250,000 per depositor, held through Evolve Bank & Trust, Member FDIC, or another partner bank. Conditions apply, as they do across the industry, but the backbone is familiar and regulated.⁴ Security and fraud prevention are treated as first‑class features rather than afterthoughts, with the platform investing in tools to detect suspicious activity and protect accounts.

Equally notable is the Member Success team—Dave’s support arm—aimed at answering questions about accounts, transactions, or eligibility. In a world where many fintech apps push users toward chatbots and self‑help articles, human backup is still a differentiator, especially when money is at stake.

The Bigger Picture: Cash Flow Without the Gotchas

What Dave is really selling is predictability: quick access to modest cash, transparent settlement, checking that doesn’t punish lean months, and savings tools that work in the background. For millions who’ve been burned by overdrafts, payday loans, or monthly “maintenance” charges, that combination can feel like a breath of fresh air.

Of course, responsible use is key. ExtraCash isn’t free money; it’s a short‑term bridge that should be repaid on time. Early direct deposit depends on your employer and payroll provider. ATM owners may levy their own fees even if Dave doesn’t. And FDIC insurance—while essential—covers deposits up to stated limits and only kicks in under specific circumstances. Understanding these nuances keeps the app’s benefits squarely in your corner.

Bottom Line

Dave’s pitch resonates because it speaks to real, everyday pain points: paying a bill before payday, filling the gas tank to get to work, or setting aside a little each week without overthinking it. If you need a fast, transparent way to smooth the rough edges of monthly cash flow—and a checking account that helps rather than hinders—Dave’s bundle of ExtraCash, Dave Checking, and Goals is engineered to do exactly that.

click here for more information...........

Want more pieces like this? Follow me so you don’t miss the next breakdown.

About the Creator

Organic Products

I was born and raised in Chicago but lived all over the Midwest. I am health, safety, and Environmental personnel at the shipyard. PLEASE SUBSCRIBE to my vocal and check out my store

Comments (1)

wow